In H1 2025, the phosphate chemical industry experienced significant price fluctuations and capacity adjustments, primarily influenced by global economic conditions, raw material supply, and growing new energy demand. Demand side, phosphorus resource consumption in the new energy sector continued to increase. Both phosphoric acid and industrial-grade MAP applications in LFP cathode materials, as well as yellow phosphorus usage in LiPF6 (the main electrolyte raw material), showed substantial year-on-year growth.

I. Price Review of Phosphate Chemical Products

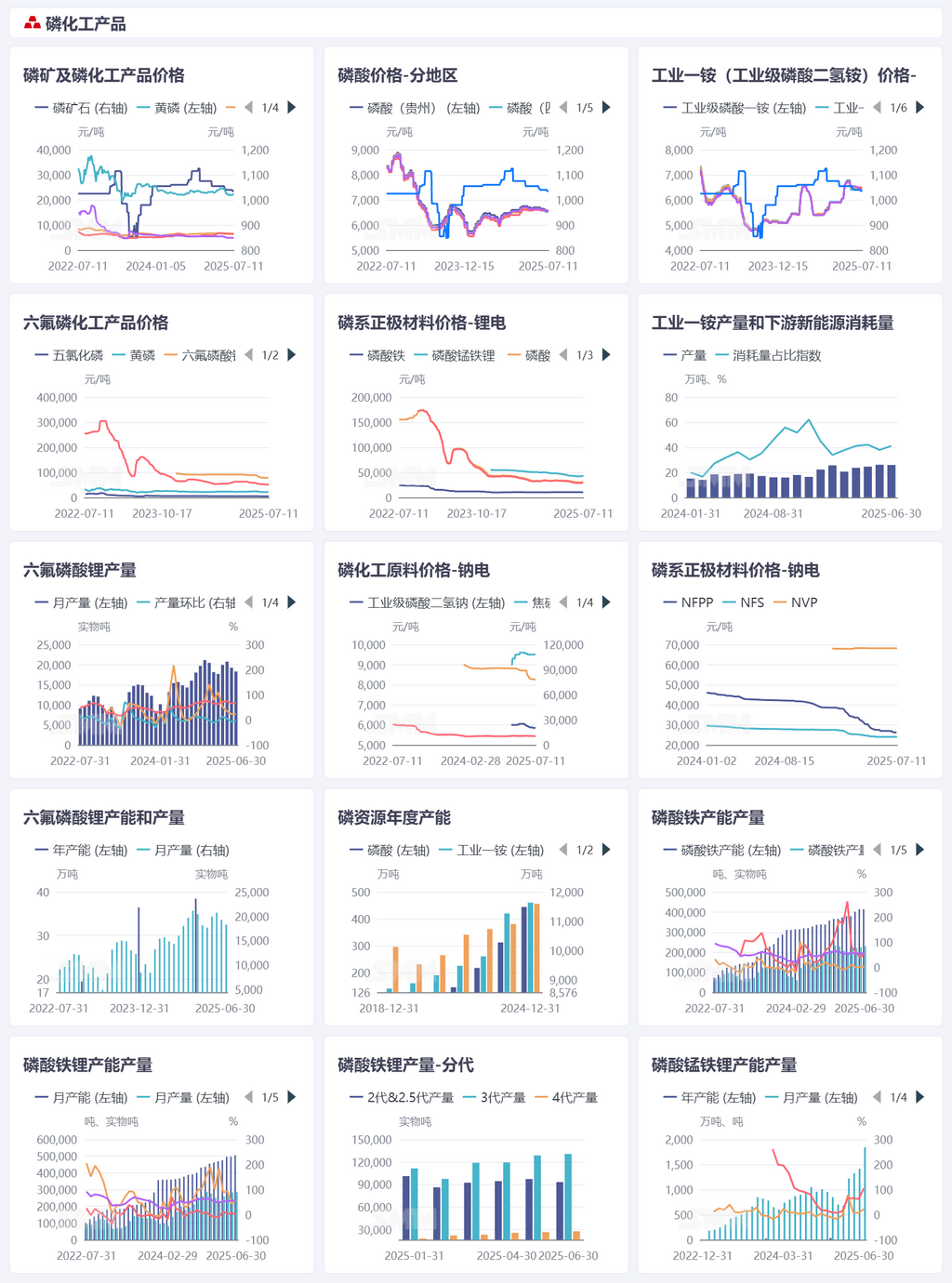

During H1 2025, phosphate chemical product prices exhibited divergent trends. Phosphate ore and phosphoric acid prices fluctuated regionally, reflecting supply-demand variations across markets. Industrial-grade MAP prices oscillated due to downstream demand and cost factors. Products like LiPF6 adjusted according to market supply-demand patterns, generally seeking equilibrium within industry cycles, demonstrating the transmission effects of the new energy industry chain.

Phosphate Ore: Prices initially rose then declined, peaking early in the year due to tight supply before pulling back with weakening demand. Phosphate ore prices are expected to remain elevated throughout the year, ensuring substantial profits for miners.

Phosphoric Acid: Regional price disparities were pronounced, with overall prices showing a stable-to-declining trend in H1. Industrial-grade MAP prices exhibited seasonal fluctuations influenced by agricultural fertilizer demand, peaking during March-April before stabilizing with a downward tendency in May-June.

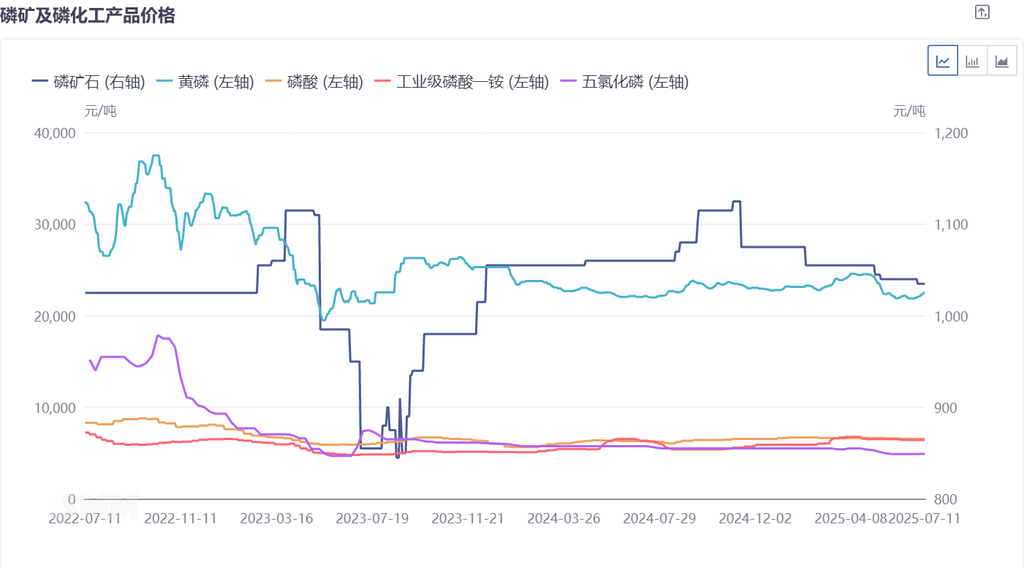

II. Capacity Under Supply-Demand Dynamics

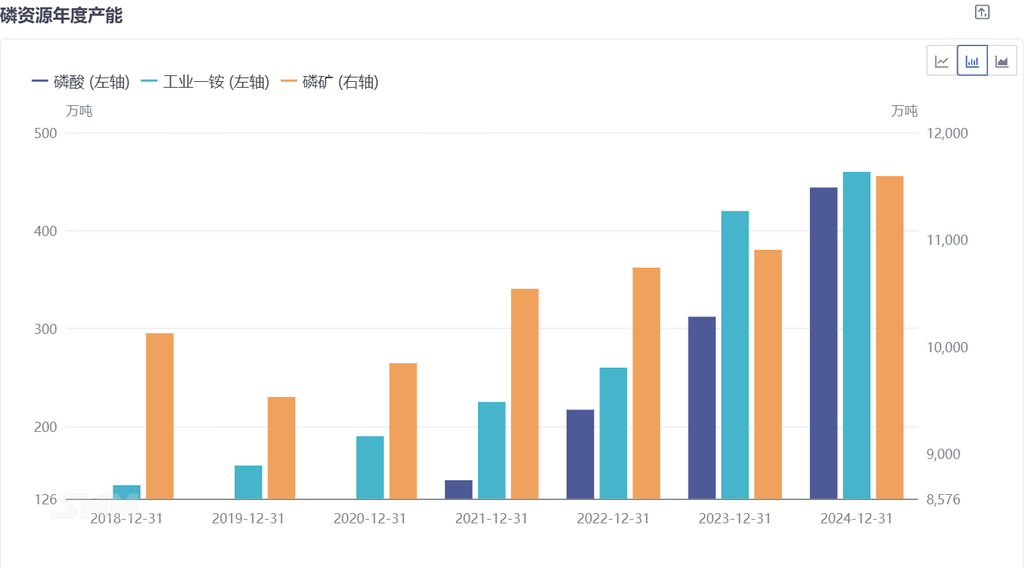

Capacity side, phosphorus resource annual capacity and segment-specific expansions (e.g., LFP) continued, with active corporate investment driving gradual industry scale effects. Production data revealed phased variations in outputs like LiPF6 and LFP, closely tied to downstream new energy demand (power batteries, ESS). Peak demand seasons boosted production, though raw material supply and production scheduling also played roles.

The phosphate chemical industry became deeply integrated with the lithium battery value chain, supporting lithium battery material systems from phosphorus-based cathode materials to electrolytes like LiPF6. Shifting consumption ratios of products like industrial-grade MAP in new energy applications reflected the sector's growing pull effect on phosphate chemicals, while raw material price volatility inversely impacted lithium battery material costs and market competition patterns.

III. H2 2025 Outlook

H1 2025 saw price volatility and demand shifts in phosphate chemical markets, yet overall growth persisted.

Short-term, H2 2025 requires monitoring how peak new energy downstream demand (e.g., NEV production/sales seasons, concentrated ESS project construction) boosts phosphate chemical products, alongside price and profit changes stemming from intensified post-capacity-release market competition.

In the long term, as the new energy industry continues to develop, the demand for high-energy-density and high-safety phosphorus-based lithium battery materials is expected to grow. Phosphorus chemical enterprises need to focus on technological R&D (such as optimizing the performance of phosphorus-based cathode materials) and industry chain collaboration (stabilizing upstream and downstream supply) to adapt to the upgrading of the new energy industry. Meanwhile, they also need to address challenges such as overcapacity and stricter environmental protection requirements to achieve sustainable development.

Note: If you have any supplementary information on the details mentioned in this article or are interested in the development of solid-state batteries, please feel free to contact us. The contact information is as follows:

Tel: 021-20707860 (or add WeChat: 13585549799) Yang Chaoxing. Thank you!

SMM New Energy Research Team

Wang Cong 021-51666838

Ma Rui 021-51595780

Feng Disheng 021-51666714

Lv Yanlin 021-20707875

Zhou Zhicheng 021-51666711

Wang Zihan 021-51666914

Zhang Haohan 021-51666752

Wang Jie 021-51595902

Xu Yang 021-51666760

Chen Bolin 021-51666836